EB-5: real success stories proving its effectiveness

Open Your Visa: The Ultimate Overview to the EB-5 Visa Investment Program

The EB-5 Visa Investment Program offers an unique path to united state permanent residency for foreign capitalists, cultivating economic growth with work production. Comprehending the details of this program is important for potential candidates, as it entails specific eligibility needs and differing investment amounts. This guide aims to light up the vital components of the EB-5 procedure, from traversing regional facilities to assessing potential dangers and incentives. Lots of financiers may overlook important details that might greatly impact their application. What are the usual mistakes that could endanger your investment journey?

What Is the EB-5 Visa?

Comprehending the EB-5 Visa is vital for foreign financiers seeking irreversible residency in the USA. Established by the Immigration Act of 1990, the EB-5 Visa program offers a pathway to authorized permanent residency for individuals who buy a united state business. This program is particularly attractive as it enables capitalists and their instant family participants-- partners and single children under 21-- to get Visa, facilitating their move to the united state

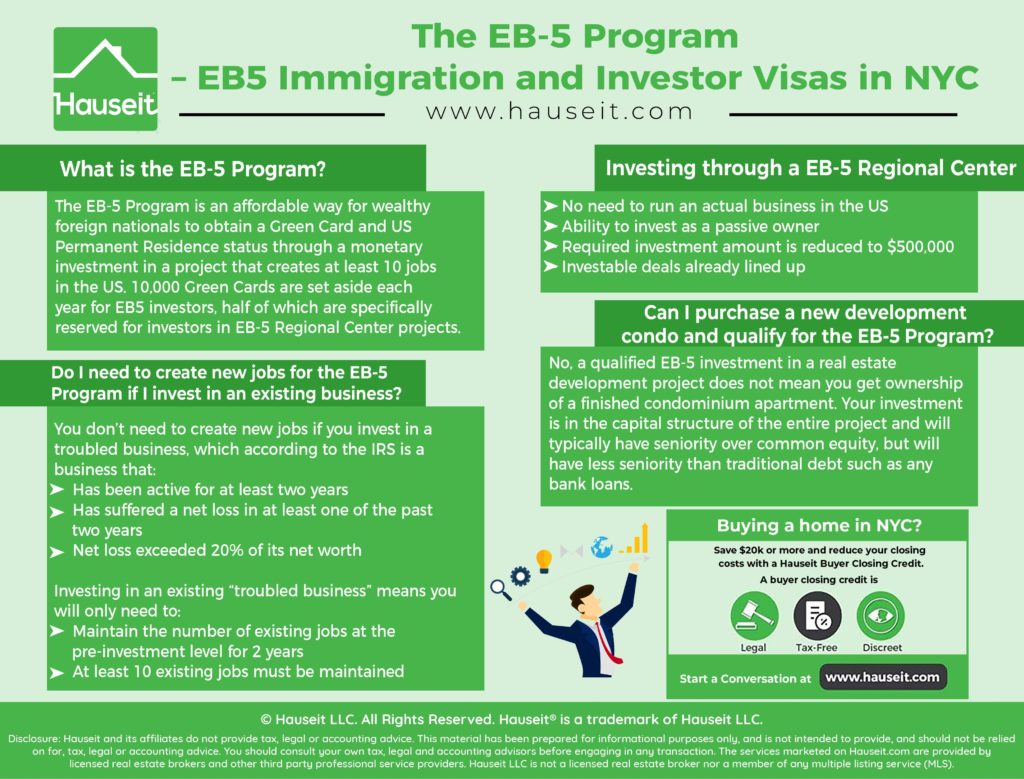

To get approved for the EB-5 Visa, financiers must make a minimal investment in a new or existing business. This investment has to preserve or create a minimum of 10 full time work for U.S. workers. The financial investment can be made straight in a company or with a designated Regional Facility, which is a company approved by U.S. Citizenship and Migration Provider (USCIS) to promote economic development with work development.

The EB-5 program is designed not only to bring in foreign funding but likewise to boost financial growth and task production in the United States. Provided its possible advantages, comprehending the subtleties of the EB-5 Visa is crucial for financiers looking to browse the intricacies of U.S. migration regulation effectively.

Eligibility Requirements

To effectively get an EB-5 Visa, applicants need to meet details qualification needs set forth by united state Citizenship and Immigration Provider (USCIS) The candidate has to be an international nationwide who shows the ability to invest in a new industrial enterprise. This endeavor has to be developed after November 29, 1990, or be a troubled venture that has actually experienced substantial losses.

The candidate must invest a minimum amount, which varies depending on the job place, and should maintain or develop at the very least 10 full time tasks for qualifying united state employees within 2 years of the investment. On top of that, the financial investment has to be at risk, implying that there is a possibility for loss along with an opportunity for gain.

It is additionally crucial that candidates confirm the lawful resource of their financial investment funds, making certain that the money was acquired via legal means. Moreover, applicants have to show their intent to live in the United States and proactively get involved in the management of the venture, whether straight or indirectly. Meeting these qualification requirements is essential for a successful EB-5 Visa, paving the method for eventual irreversible residency.

Investment Quantities

When thinking about the EB-5 Visa program, prospective capitalists must understand the specific financial investment quantities required, which are essential to the application process. The basic investment quantity is currently established at $1 million. This number is substantially decreased to $500,000 if the financial investment is made in a targeted work location (TEA) TEAs are defined as country areas or areas experiencing high unemployment, providing a distinct possibility for capitalists to add to economically troubled communities while also satisfying visa requirements.

It is necessary for capitalists to understand that these amounts undergo alter, as they are periodically reviewed by the U.S. Citizenship and Migration Provider (USCIS) Furthermore, the financial investment should be made in a new company that maintains or develops a minimum of 10 permanent tasks for qualifying united state workers within 2 years of the financier's admission to the USA.

Selecting the right financial investment opportunity is essential, as it not just affects the probability of effective visa authorization but additionally the investor's financial returns. Consequently, complete research and due diligence are crucial before devoting to any investment under the EB-5 program.

Application Process

The application procedure for the EB-5 Visa Investment Program includes a number of essential actions that guarantee conformity with qualification demands. Comprehending these demands is necessary for potential candidates to browse the procedure successfully. This area describes the required steps to successfully submit an EB-5 application.

Eligibility Requirements Explained

Understanding the eligibility needs for the EB-5 Visa financial investment program is vital for possible investors, as these criteria regularly establish the success of their application. The EB-5 Visa is created for foreign nationals seeking permanent residency in the United States through investment in a new industrial business.

To certify, candidates should invest a minimum of $1 million, or $500,000 in targeted work areas (TEAs), which are specified as country or high-unemployment areas. The financial investment has to maintain or produce at the very least ten full time work for certifying united state employees within two years of the investor's admission to the united state as a conditional long-term local.

Additionally, financiers have to demonstrate that their financial investment funds are derived from legal resources, giving paperwork to verify the origin of the funding. Applicants must also be prepared to actively take part in business operation, although this need might be extra versatile for financial investments made through Regional Centers.

It is necessary for potential financiers to very carefully assess their eligibility and talk to immigration experts to browse the intricacies of the EB-5 Visa program successfully, ensuring conformity with all guidelines and optimizing their opportunities for authorization.

Step-by-Step Application Process

Maneuvering the application process for the EB-5 Visa investment program calls for mindful preparation and attention to information. The trip starts with picking a suitable investment opportunity, preferably through a Regional Center, to ensure compliance with program requirements. Conduct complete due diligence to evaluate the job's stability and work creation possibility.

Once you have actually made your investment, the following action is to prepare Kind I-526, Immigrant Request by Alien Financier. This kind needs supporting documentation, including evidence of your financial investment funds' legal resource and a substantial organization strategy describing task creation metrics.

After the USCIS processes Form I-526 and approves it, you can progress with either adjusting your standing if already in the U.S. or using for an immigrant visa at an U.S. consular office abroad. You will need to submit Kind DS-260, Immigrant Visa and Alien Registration Application, together with medical exams and other called for papers.

Regional Centers vs. Direct Investment

Regional facilities are marked companies that handle specific EB-5 investment tasks. They usually merge funds from multiple financiers to finance larger projects, such as property growths or infrastructure campaigns. This choice normally enables investors to take advantage of a more passive financial investment approach, as local centers take care of project administration and job development demands in support of the financiers.

On the other hand, direct investment requires the capitalist actively handling a brand-new or current business, thereby straight controlling their investment. This path may attract those with entrepreneurial experience or a desire to involve carefully with their organization procedures. However, it calls for an extra hands-on method, including meeting particular work production criteria straight connected to the financier's business.

Inevitably, the choice between regional facilities and direct investment depends upon an investor's economic objectives, danger tolerance, and involvement degree in business venture. Careful consideration of these variables is essential for a successful EB-5 investment experience.

Possible Threats and Rewards

Investing with the EB-5 Visa program offers both substantial possibilities and inherent risks that potential investors need to meticulously assess. Trick factors to consider consist of the financial ramifications of the financial investment, obstacles associated to the immigration process, and the possible impact of market volatility on job outcomes. Understanding these aspects is crucial for making informed decisions that align with specific objectives and conditions.

Financial Investment Considerations

Maneuvering the landscape of the EB-5 Visa Investment Program calls for a thorough understanding of potential economic threats and incentives related to this unique opportunity. Investors need to thoroughly consider the advantages of acquiring long-term residency in the USA versus the monetary dedications included.

One of the primary benefits of the EB-5 program is the prospective return on investment, which can vary considerably depending upon the project picked. Well-structured financial investments can generate considerable revenues while assisting to develop work for U.S. workers. In enhancement, effective involvement in the program can result in a pathway for household members to gain residency, adding to the program's allure.

Alternatively, financial threats are fundamental in any kind of financial investment. The success of the project might pivot on various factors such as market problems, administration proficiency, and regulatory modifications (EB-5). Financiers may face the possibility why not try here of shedding their capital if the task stops working to meet its goals. Furthermore, the demand of maintaining the financial investment for a particular duration can pose liquidity obstacles

Ultimately, comprehensive due persistance and a clear understanding of both monetary threats and benefits are necessary for potential EB-5 capitalists intending to protect their visa through this financial investment path.

Immigration Process Obstacles

Although the EB-5 Visa Investment Program uses a pathway to irreversible residency, steering with the migration process offers its very own collection of obstacles that potential capitalists must very carefully think about. One significant obstacle includes the substantial paperwork needed to confirm the authenticity of the financial investment. Investors should provide comprehensive monetary documents, resource of funds, and proof showing job production, which can be both taxing and facility.

One more difficulty is the developing nature of immigration legislations and policies, which can affect qualification and authorization prices. Following these changes is crucial, as they might present brand-new difficulties or modify present paths. Regardless of these challenges, successful navigation of the immigration process can cause the gratifying end result of getting a Permit and the associated benefits of long-term residency in the USA.

Market Volatility Effect

Maneuvering the landscape of the EB-5 Visa Investment Program calls for an acute understanding of market volatility, which can significantly influence both the dangers and incentives connected with foreign investment. Market variations can affect the success of projects backed by EB-5 financial investments, bring about differing results for financiers.

On one hand, beneficial market problems can boost job feasibility, causing significant returns and a quicker path to permanent residency (EB-5 Visa by Investment). Conversely, unfavorable market fads may threaten project completion, reducing the likelihood of an effective financial investment and possibly causing financial losses

Financiers must conduct complete due persistance to assess the financial security and development possibility of the jobs they think about. Examining market trends, local financial problems, and the track document of the task designers can minimize threats associated with volatility. Additionally, diversifying investments throughout multiple tasks may supply a barrier versus prospective downturns.

Ultimately, understanding market dynamics is crucial for EB-5 capitalists. While the prospective benefits can be significant, the coming with risks necessitate an educated approach to investment decisions within this program. Mindful preparation and critical investment can reveal the path to both financial gain and U (EB-5).S. residency

Success Stories and Testimonials

The EB-5 Visa Investment Program has actually changed the lives of numerous people and family members, offering them with opportunities to achieve their American Desire. EB-5 Visa by Investment. Several participants have shared motivating testaments concerning their trips with the program, highlighting both the difficulties and rewards they encountered along the road

For example, the Nguyen household from Vietnam effectively navigated the EB-5 process, allowing them to transfer to the USA. They highlighted exactly how the program not only provided them with a path to long-term residency yet additionally enabled them to purchase a growing neighborhood service, developing tasks and contributing to their new community. Their tale shows the program's twin effect on both the financier and the economic situation.

Similarly, a business owner from China stated exactly how the EB-5 program facilitated his need to broaden his tech start-up in the U.S. By safeguarding financing with the financial investment needs, he was able to bring ingenious products to market while all at once safeguarding his household's future in America.

These endorsements illustrate the extensive effect of the EB-5 Visa Investment Program, showcasing how it equips people to seek new chances and attain lasting success in their brand-new homeland.

Regularly Asked Concerns

Just how Long Does the EB-5 Visa Process Commonly Take?

The EB-5 visa procedure usually takes 18 to 24 months from application entry to authorization. However, processing times might vary based on specific conditions, USCIS workload, and regional facility task specifics, possibly extending the timeline.

Can Family Members Apply With the Key Financier?

Yes, member of the family can use along with the primary capitalist under the EB-5 visa program. Immediate family members, consisting of spouses and single youngsters under 21, are qualified for acquired visas, facilitating their residency in the United States.

What Occurs if My Investment Fails?

If your investment falls short, it may endanger your immigration standing. The U.S. Citizenship and Migration Services requires evidence of financial investment and job creation; failure to satisfy these standards can result in visa denial or cancellation.

Are There Age Restrictions for EB-5 Candidates?

There are no particular age restrictions for EB-5 applicants. Nonetheless, all candidates, despite age, must meet the program's investment needs and demonstrate the ability to sustain the financial investment within the assigned duration.

Can I Keep My International Citizenship While Holding an EB-5 Visa?

Yes, individuals holding an EB-5 visa can preserve their foreign citizenship. The EB-5 visa does not require candidates to renounce their original nationality, allowing dual citizenship status, subject to the laws of their home country.

The EB-5 Visa Investment Program supplies an unique pathway to United state permanent residency for foreign capitalists, promoting economic growth through job production. Understanding the qualification needs for the EB-5 Visa investment program is vital for potential investors, as these criteria regularly establish the success of their application. In contrast, straight investment entails the investor proactively taking care of a existing or brand-new service, consequently directly managing their investment. The EB-5 Visa Investment Program offers a path to long-term residency, steering via the immigration process offers its very own set of obstacles that possible investors have to meticulously think about - EB-5 Visa by Investment. Maneuvering the landscape of the EB-5 Visa Investment Program calls for an intense awareness of market volatility, which can substantially affect both the dangers and benefits connected with foreign financial investment